The Banking Digital Transformation Question Every Executive Is Asking

When Saudi Arabia’s digital banking market grows from USD 87.60 million in 2024 to a projected USD 278.19 million by 2033 at a CAGR of 12.70%, one question dominates boardroom discussions: which banks will capture this exponential growth through successful banking digital transformation, and which will be left behind?

The answer lies in a strategic convergence of AI-powered customer experiences and cloud-first infrastructure that forward-thinking institutions are implementing today. While some banks debate banking digital transformation budgets, market leaders are already deploying solutions that deliver 30-40% operational efficiency gains and measurably superior customer satisfaction scores.

The Strategic Reality: Banks implementing comprehensive banking digital transformation strategies now are positioning themselves to dominate a rapidly expanding digital market with unprecedented growth opportunities.

For strategic insights on digital banking implementation, explore Alnafitha’s Banking Technology Solutions and discover how leading Saudi banks are achieving competitive advantage.

Why Banking Digital Transformation Cannot Wait

The transformation of Saudi banking isn’t coming—it’s here. Current market data reveals the scale of change that makes banking digital transformation an immediate strategic priority:

The Market Intelligence Saudi Banking Leaders Need

Digital Adoption Has Reached Critical Mass

The transformation of Saudi banking isn’t coming—it’s here. Current market data reveals the scale of change:

The Saudi Arabia digital banking market size reached USD 87.60 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 278.19 Million by 2033, exhibiting a growth rate (CAGR) of 12.70% during 2025-2033.

There were 36.84 million internet users in Saudi Arabia at the start of 2024, when internet penetration stood at 99.0 percent. This universal connectivity creates unprecedented opportunities for banks that can deliver seamless digital experiences.

The Technology Infrastructure Is Ready

Smartphone Penetration Excellence: The number of smartphone users in Saudi Arabia has grown from 14.31 million in 2013 to 33.55 million in 2024. With 97 percent smartphone penetration forecast for 2024, the infrastructure for mobile-first banking is mature.

Payment System Momentum: The Saudi Arabian payments landscape is primed for substantial growth, promising to escalate from a value of USD 163.93 billion in 2024 to an anticipated USD 269.91 billion by the end of 2029 with a CAGR of 10.49%.

AI Customer Experience Excellence Drives Competitive Advantage

Real Implementation Results

Leading Saudi banks are achieving measurable results through AI customer experience initiatives. Saudi National Bank (SNB) implemented chatbots that are accessible 24/7 to provide customers with quick responses and an AI-based fraud detection system to analyse customer behaviour and transactions.

Strategic AI Applications Delivering Results:

Operational Efficiency Enhancement

- Automated back-office processes reducing manual intervention by 60%

- Real-time fraud detection preventing losses before they occur

- Intelligent customer service reducing response times from hours to seconds

Customer Personalization at Scale

- Predictive analytics anticipating customer needs

- Customized product recommendations increasing cross-selling success

- Dynamic pricing models optimizing profitability per customer segment

The Technology Leadership Examples

Arab National Bank’s Strategic Approach: ANB has been a pioneer in co-innovating with fintechs, adopting technologies like APIs, event-driven architectures, and artificial intelligence to explore new opportunities. Their strategic implementation demonstrates how banking app modernization creates sustainable competitive advantages.

Riyad Bank’s AI Innovation Center: On July 23, 2024, Riyad Bank announced the establishment of the Center of Intelligence, the first specialized artificial intelligence hub in Saudi Arabia’s banking sector. This initiative aims to enhance operational efficiency and customer experience by leveraging advanced AI technologies and machine learning solutions.

Financial Cloud Innovation Infrastructure Requirements

The Government’s Cloud-First Strategy Creates Opportunity

Saudi Arabia’s commitment to cloud adoption extends beyond policy statements. According to IDC, spending on AI in Saudi Arabia will surpass $720 million in 2024 and will reach $1.9 billion by 2027 at a CAGR of 40%, demonstrating the scale of investment in supporting technologies.

Cloud Infrastructure Investment Scale: Annual spending on public cloud services forecasted to surpass $2.4 billion in 2024 and to reach $4.7 billion in 2027, according to IDC research data.

Learn more about cloud banking strategies in our comprehensive guide: Alnafitha Cloud Banking Implementation Framework.

Implementation Benefits Banks Are Achieving

Scalability and Performance

- Instant resource allocation during peak transaction periods

- Global availability ensuring 99.9% uptime

- Auto-scaling capabilities managing demand fluctuations

Cost Optimization Results

- 30-50% reduction in traditional IT infrastructure costs

- Pay-per-use models optimizing operational expenses

- Reduced capital expenditure requirements for technology upgrades

Security and Compliance Enhancement

- Advanced threat detection capabilities

- Automated compliance reporting and monitoring

- Data encryption and protection exceeding traditional standards

Banking App Modernization for Market Leadership

The Mobile-First Customer Expectation

The widespread adoption of smartphone banking and digital services has significantly transformed the financial sector in Saudi Arabia. Smartphones with internet connectivity serve as the primary consumer access point for financial services in Saudi Arabia.

Critical Design Requirements for Saudi Market Success:

Islamic Banking Integration

- Sharia-compliant product offerings and calculations

- Arabic language optimization with proper RTL support

- Cultural sensitivity in user interface design

For specialized Islamic banking technology solutions, explore Alnafitha’s Compliant Banking Systems.

Government Services Integration

- Seamless connectivity with Vision 2030 digital initiatives

- Integration with national payment systems like Mada and SARIE

- Support for government payment and collection services

Successful Implementation Examples

Saudi National Bank’s NEO Platform: In September 2024, Saudi National Bank (SNB) launched NEO, a new digital banking app. This innovative platform is designed to offer convenient and modern banking services, providing customers with access to a wide range of digital financial solutions.

Vision Bank’s Digital Innovation: In September 2024, Vision Bank, the first Sharia-based digital bank of Saudi Arabia, announced the launch of its mobile application after almost two years of development.

Open Banking Competitive Framework

SAMA’s Regulatory Foundation

Since 2021, when the Saudi Central Bank (SAMA) launched its roadmap for implementing Open Banking, the Kingdom has witnessed remarkable growth in this sector, culminating in the establishment of the Open Banking Framework in November 2022 and the Open Banking Lab in January 2023.

This regulatory structure enables banks to achieve:

Innovation Acceleration

- Rapid integration with fintech partners through standardized APIs

- Faster time-to-market for new financial products

- Collaborative development with technology providers

Customer Data Monetization

- Comprehensive financial behaviour insights

- Enhanced risk assessment capabilities

- Personalized service delivery at scale

New Revenue Stream Creation

- Platform-based business models

- Partnership revenue sharing

- Value-added service offerings

Strategic Partnership Opportunities

Fintech Ecosystem Integration: The open banking framework creates opportunities for strategic partnerships that enhance service portfolios while maintaining regulatory compliance.

API-First Architecture Benefits: Banks implementing robust API strategies can rapidly deploy new services, integrate with partners, and scale operations efficiently.

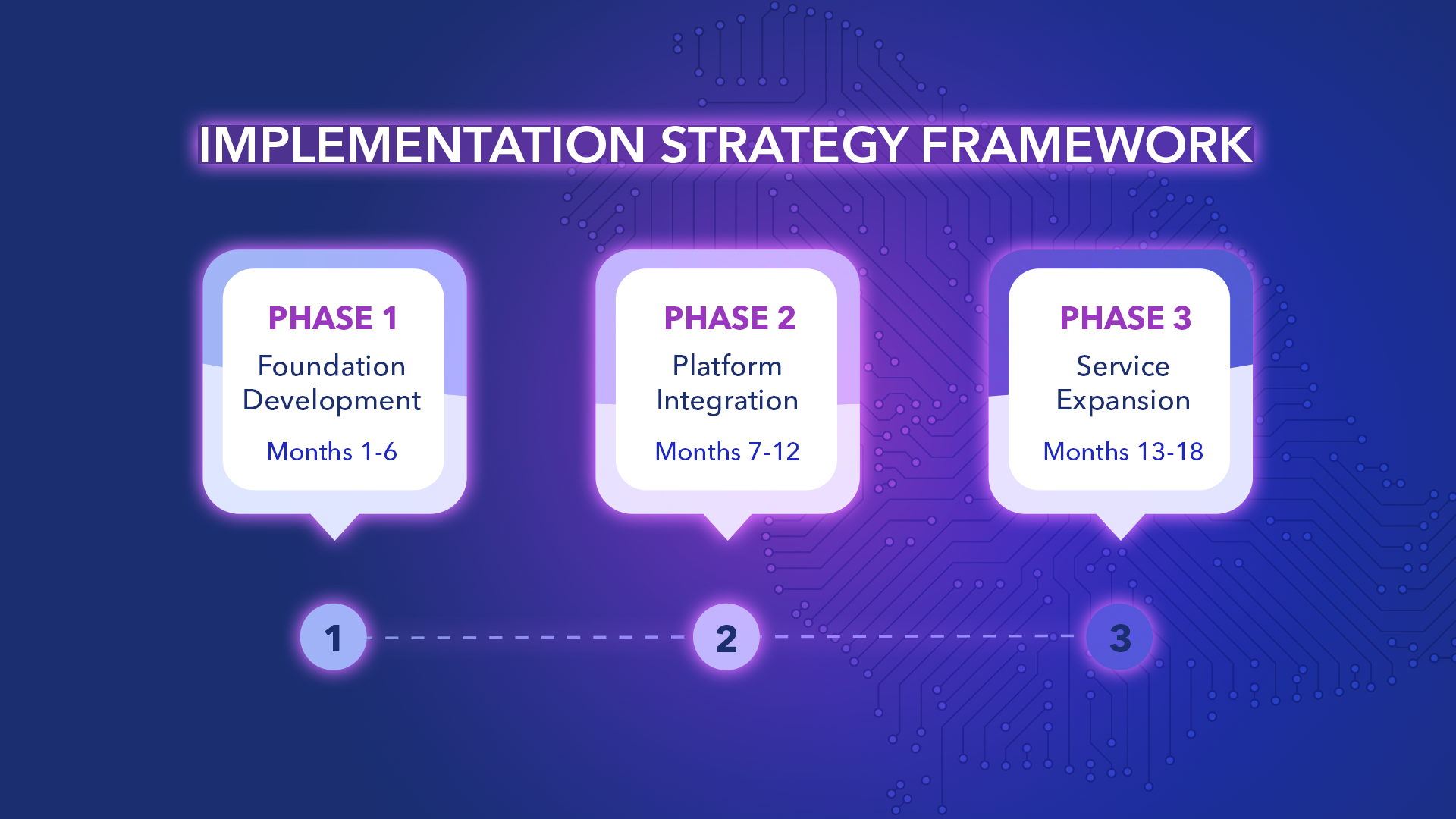

Implementation Strategy Framework

Phase 1 – Foundation Development (Months 1-6)

Technology Infrastructure Assessment

- Current system capabilities evaluation

- Cloud readiness analysis

- Security framework gap analysis

- API architecture planning

Regulatory Compliance Establishment

- SAMA requirements implementation

- Data protection framework deployment

- Customer consent management systems

- Audit trail establishment

Phase 2 – Platform Integration (Months 7-12)

Cloud Migration Execution

- Core banking system modernization

- Data migration and validation

- Performance optimization

- Security testing and validation

AI Capability Implementation

- Customer service chatbot deployment

- Fraud detection system activation

- Predictive analytics platform launch

- Personalization engine development

Phase 3 – Service Expansion (Months 13-18)

Advanced Feature Rollout

- Mobile app enhancement release

- Open banking API activation

- Partner ecosystem integration

- Advanced analytics dashboard deployment

Performance Optimization

- User experience refinement

- System performance tuning

- Security enhancement implementation

- Compliance monitoring activation

Success Measurement and ROI Tracking

Customer Experience Metrics

Digital Adoption Indicators

- Mobile app monthly active users growth rate

- Digital transaction volume percentage increase

- Customer satisfaction score improvements

- Customer service response time reduction

Financial Performance Measures

- Revenue per digital customer enhancement

- Cost per transaction reduction percentage

- New customer acquisition through digital channels

- Cross-selling success rate improvements

Operational Excellence Benchmarks

Efficiency Gains

- Manual process automation percentage

- Employee productivity improvements

- Error rate reduction in transaction processing

- Time-to-market reduction for new services

Risk Management Enhancement

- Fraud detection accuracy improvements

- Compliance reporting automation

- Security incident reduction

- Regulatory requirement adherence

Future Technology Integration Planning

Emerging Technology Preparation

Quantum Computing Readiness Preparing for next-generation encryption and processing capabilities that will redefine financial security and computational speed.

5G Network Optimization 5G can transform Saudi Arabia into a Gigabit society, offering speeds up to 100 times faster than 4G and latency as low as 1ms. This infrastructure enables real-time financial services and enhanced customer experiences.

IoT Financial Services Integration According to the International Data Corporation (IDC), Saudi Arabia’s IoT market is estimated to reach $2.9 billion by 2025 with an annual growth rate of 12.8%. This creates opportunities for connected banking services and smart payment solutions.

Regulatory Evolution Adaptation

SAMA Compliance Framework

- Staying ahead of evolving regulatory requirements

- Implementing proactive compliance monitoring

- Preparing for international banking integration standards

Data Protection Excellence

- Robust privacy framework implementation

- Cross-border data handling compliance

- Customer consent management optimization

Strategic Decision Framework

The convergence of AI, cloud computing, and regulatory support creates a limited-time competitive opportunity for Saudi banks. Organizations implementing comprehensive banking digital transformation strategies today will define market leadership tomorrow.

Critical Success Elements:

- Strategic Vision Alignment – Banking digital transformation investments must align with Vision 2030 objectives and business growth targets

- Customer-Centric Focus – Every AI customer experience decision should prioritize customer value and satisfaction

- Partnership Ecosystem Development – Building collaborative relationships with fintech’s and technology providers

- Continuous Innovation Culture – Maintaining organizational agility in rapidly evolving markets

- Risk Management Excellence – Balancing innovation speed with security and regulatory compliance

The Strategic Question: Will your bank lead the banking digital transformation through financial cloud innovation, or will competitors capture the market advantages while you plan?

The window for first-mover advantage in Saudi Arabia’s digital banking market is narrowing. Banks that execute comprehensive banking digital transformation through banking app modernization and AI integration strategies in 2025 will establish competitive positions that become increasingly difficult for later adopters to challenge.

Start accelerating your banking digital transformation strategy

Contact Alnafitha Solutions for expert consultation on AI-powered banking strategies designed for the Saudi market. Our expertise in local regulations, customer behavior, and technology implementation ensures your transformation initiatives deliver competitive advantage and measurable ROI.