The financial technology landscape in Saudi Arabia is experiencing unprecedented growth, with the Kingdom positioning itself as a regional fintech hub. For businesses looking to enter this dynamic market, understanding fintech licensing in Saudi Arabia is crucial for success. This guide explores the regulatory framework, licensing requirements, and how specialized consulting services can help you navigate this complex landscape.

Understanding Fintech Licensing: What Is a Fintech License?

A fintech license is a regulatory authorization that allows companies to provide financial technology services legally within Saudi Arabia. The Saudi Central Bank (SAMA) serves as the primary regulator for fintech activities, ensuring that financial services remain secure, transparent, and aligned with the Kingdom’s financial sector development objectives.

What exactly is fintech? Financial technology encompasses digital solutions that transform traditional financial services, including digital payments, crowdfunding platforms, robo-advisory services, and digital banking solutions. Companies providing these services must obtain proper fintech licensing in Saudi Arabia to operate legally and build customer trust.

Which Regulatory Bodies Oversee Fintech Licensing Processes in Saudi Arabia?

The regulatory landscape for fintech licensing in Saudi Arabia involves multiple entities, each with specific jurisdictions:

Saudi Central Bank (SAMA) regulates payment service providers, digital banking, debt-based crowdfunding, and microfinance activities. SAMA has played a central role in developing the Kingdom’s fintech ecosystem through initiatives like the Regulatory Sandbox and the Financial Sector Development Program.

Capital Market Authority (CMA) oversees fintech activities related to securities and capital markets, including equity crowdfunding platforms, robo-advisory services, and social trading platforms. The CMA ensures investor protection and market integrity through its Financial Technology Experimental Permit Instructions.

The Ministry of Investment (MISA) handles foreign investment approvals for international fintech companies establishing a presence in Saudi Arabia.

The Ministry of Commerce manages licensing and commercial regulations for business operations.

Understanding which regulatory body governs your specific fintech activity is the first step toward successful fintech licensing in Saudi Arabia.

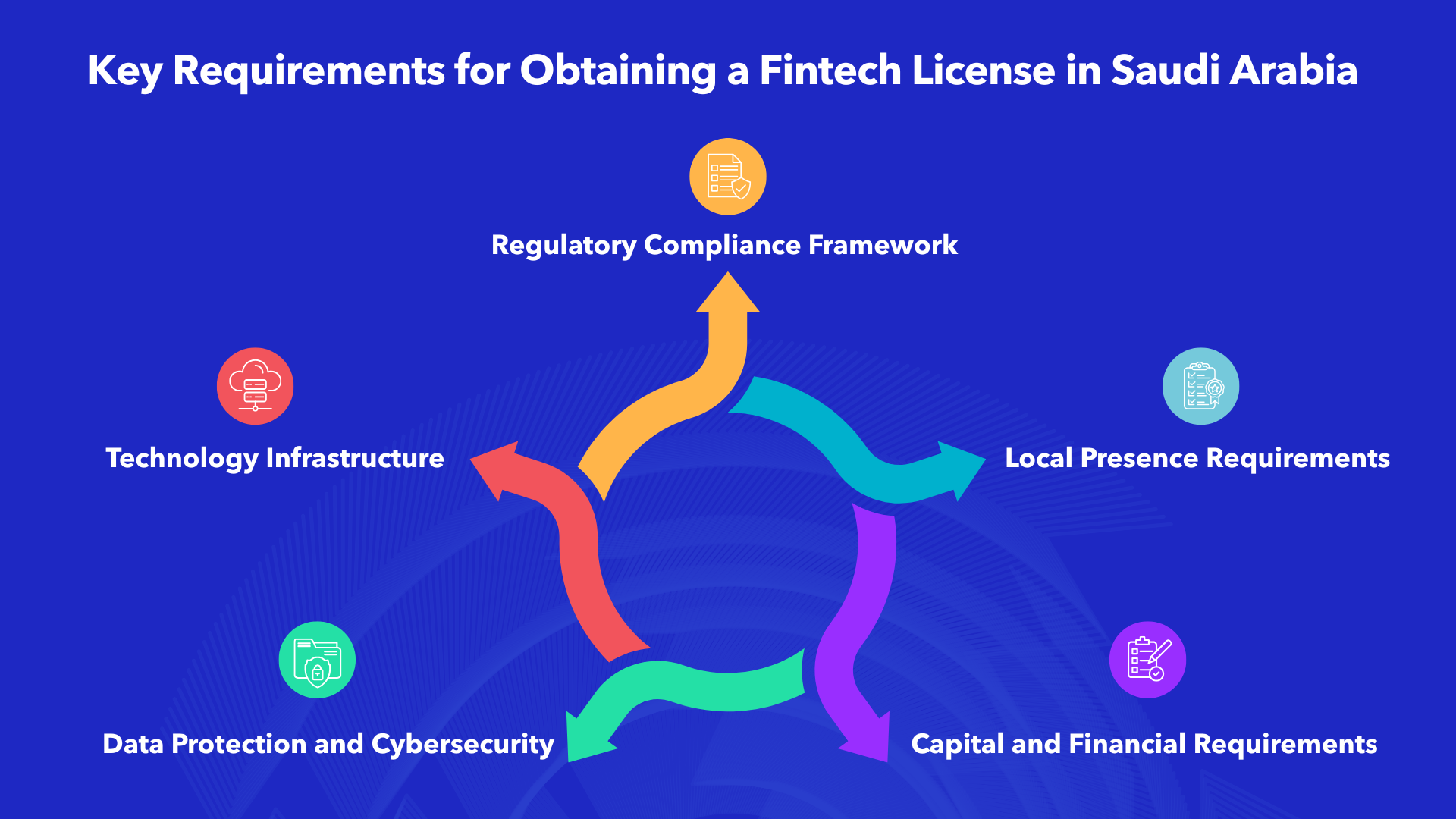

Key Requirements for Obtaining a Fintech License in Saudi Arabia

The process of obtaining fintech licensing in Saudi Arabia involves meeting specific criteria established by SAMA and other relevant authorities. Here are the essential requirements:

Regulatory Compliance Framework

Companies must demonstrate compliance with Saudi Arabian financial regulations, including anti-money laundering laws under Cabinet Decision No. 80/1439 and Know Your Customer (KYC) requirements. SAMA requires robust monitoring systems to detect and prevent illicit financial activities.

Local Presence Requirements

International fintech companies have four primary options for entering the Saudi market: establishing a subsidiary within the Kingdom, launching a new fintech company based in Saudi Arabia, licensing technology to a local Saudi startup, or appointing a sales agent. Each approach carries its own regulatory considerations for fintech licensing in Saudi Arabia.

Capital and Financial Requirements

Saudi Arabian tax laws are fintech-friendly, applying only 2.5% tax on local companies’ capital and 20% on foreign shareholders’ revenue. However, companies must demonstrate adequate capitalization to support their proposed operations.

Data Protection and Cybersecurity

Through its General Principles for Personal Data Protection, the Communications, Space and Technology Commission (CSTC) imposes obligations on service providers to maintain and protect user data. Companies seeking fintech licensing in Saudi Arabia must implement robust cybersecurity frameworks aligned with SAMA’s Cybersecurity Framework.

Technology Infrastructure

Applicants must demonstrate that their technology infrastructure is secure, scalable, and capable of handling the proposed volume of transactions while maintaining service quality and reliability.

How Can I Apply for a Digital Banking License in Saudi Arabia?

The pathway to obtaining fintech licensing in Saudi Arabia for digital banking services typically follows one of two routes:

SAMA Regulatory Sandbox Program

The Regulatory Sandbox provides a controlled environment for testing innovative solutions under regulatory supervision. This approach allows fintechs to develop and refine their offerings with limited risk while demonstrating compliance with SAMA regulations.

The Sandbox is open to SAMA-licensed innovators testing solutions covered or not covered by existing permissions, non-licensed local fintech firms, and non-licensed international fintech firms. Successful Sandbox participants can transition to full unrestricted licenses once they meet all regulatory requirements.

Direct Licensing Application

Companies with proven track records and complete documentation can apply directly for fintech licensing in Saudi Arabia. This pathway typically requires several months for SAMA to review the application, depending on the complexity of the business model and the completeness of documentation.

The application process demands comprehensive documentation covering business plans, financial projections, risk management frameworks, compliance procedures, technology architecture, and management team credentials.

What Is the Average Timeline for Fintech License Approval in Saudi Arabia?

The timeline for fintech licensing in Saudi Arabia varies based on several factors, but understanding the typical process helps set realistic expectations.

For Regulatory Sandbox applications, innovators have 30 days to complete their application form once the Sandbox window opens. The testing period typically lasts six to twelve months, during which companies operate under temporary restricted permissions.

Direct licensing applications generally take several months for SAMA to review and process. The exact timeline depends on the business model complexity, documentation completeness, regulatory clarifications needed, and the applicant’s responsiveness to SAMA’s inquiries.

Companies can expedite the fintech licensing in Saudi Arabia process by working with experienced consultants who understand regulatory requirements and can ensure applications are complete and accurate from the outset.

Can I Convert an Existing Financial License into a Fintech License in Saudi Arabia?

SAMA-licensed financial institutions already operating in the Kingdom may have streamlined pathways to expand into fintech services. Banks and insurance companies can use the Regulatory Sandbox to test solutions not covered by their existing permissions.

The conversion or expansion process for fintech licensing in Saudi Arabia requires demonstrating how the proposed fintech solution differs from existing authorized services, ensuring compliance with fintech-specific regulations, updating technology infrastructure to support new services, and implementing additional risk management and compliance controls.

Existing financial institutions benefit from established relationships with SAMA and proven compliance track records, potentially accelerating the fintech licensing in Saudi Arabia process for new fintech offerings.

What Fintech Licensing Solutions Do Top Compliance Firms Offer in the Middle East?

Navigating fintech licensing in Saudi Arabia requires specialized expertise in regulatory frameworks, compliance requirements, and market dynamics. Leading compliance firms in the region offer comprehensive solutions designed to streamline the licensing process and ensure ongoing regulatory adherence.

Strategic Regulatory Consulting

Expert consultants provide guidance on selecting the appropriate licensing pathway, whether through the SAMA Regulatory Sandbox, direct licensing, or partnership structures. They help companies understand which regulatory bodies govern their specific activities and develop strategies aligned with Vision 2030 objectives.

Alnafitha IT, a leading technology solutions provider in Saudi Arabia, offers specialized consulting services that bridge technology implementation with regulatory compliance. Their expertise in the Saudi market enables fintech companies to navigate fintech licensing in Saudi Arabia while building robust technological foundations.

Compliance Framework Development

Establishing full-scale compliance frameworks is essential for successful fintech licensing in Saudi Arabia. Professional services include developing anti-money laundering procedures, implementing Know Your Customer verification systems, creating data protection policies aligned with CSTC requirements, establishing cybersecurity frameworks meeting SAMA standards, and designing transaction monitoring systems.

These frameworks must be documented thoroughly and implemented effectively to satisfy SAMA’s rigorous review process. Alnafitha’s cybersecurity solutions help fintech companies establish the security infrastructure required for regulatory compliance.

Technology Architecture Assessment

SAMA requires fintech applicants to demonstrate robust, secure, and scalable technology infrastructure. Consulting firms evaluate existing systems, identify gaps in security and compliance, recommend technology upgrades or implementations, and ensure integration capabilities with Saudi banking systems and payment networks.

Alnafitha’s technology infrastructure services support fintech companies in building platforms that meet regulatory requirements while delivering exceptional user experiences.

Application Preparation and Documentation

The fintech licensing in Saudi Arabia application process demands extensive documentation. Professional consultants assist with preparing detailed business plans tailored to Saudi market conditions, developing comprehensive financial projections demonstrating viability, creating risk management frameworks addressing regulatory concerns, documenting technology architecture and security measures, and compiling management team credentials and organizational structures.

Ongoing Compliance Management

Securing fintech licensing in Saudi Arabia is only the beginning. Maintaining compliance requires continuous monitoring, reporting, and adaptation to evolving regulations. Compliance firms provide ongoing regulatory monitoring and updates, periodic compliance audits and assessments, staff training on regulatory requirements, liaison services with SAMA and other regulatory bodies, and incident response planning and support.

Are There Consulting Services That Specialize in Saudi Fintech Licensing?

Yes, several consulting firms specialize in supporting companies through the fintech licensing in Saudi Arabia process. These specialists combine deep understanding of Saudi regulatory frameworks with practical experience guiding companies through successful licensing applications.

Specialized fintech licensing consultants offer local market knowledge including cultural considerations and business practices, established relationships with SAMA and other regulatory authorities, experience with successful licensing applications across various fintech categories, and understanding of common pitfalls and how to avoid them.

Alnafitha IT stands out as a trusted partner for companies navigating fintech licensing in Saudi Arabia. With over 30 years of experience in the Saudi technology sector since 1993, Alnafitha brings detailed understanding of local regulatory requirements, proven track record implementing compliant technology solutions, and expertise in cybersecurity, data protection, and infrastructure management essential for fintech operations.

Our services extend beyond licensing support to include technology implementation, ongoing compliance management, and digital transformation strategies aligned with Saudi Arabia’s Vision 2030 objectives.

Fintech Licensing Regulations: What You Need to Know

Understanding the regulatory framework governing fintech licensing in Saudi Arabia helps companies prepare effectively for the application process and ongoing operations.

Payment Services Regulations

SAMA introduced new regulations in 2020 governing payment service providers. These regulations establish licensing requirements for digital wallets, money transfer services, payment gateway providers, and point-of-sale solutions. Companies providing payment services must obtain specific fintech licensing in Saudi Arabia authorizations.

Debt-Based Crowdfunding Regulations

SAMA’s 2020 regulations also created a framework for debt-based crowdfunding platforms. These platforms must secure licenses demonstrating ability to assess borrower creditworthiness, protect investor interests, maintain transparent operations, and comply with Sharia principles where applicable.

Insurance Technology (Insurtech) Regulations

The Insurance Authority (IA) regulates insurtech activities in Saudi Arabia. Companies developing insurance distribution platforms, claims processing solutions, or risk assessment technologies must coordinate with both the IA and SAMA for appropriate fintech licensing in Saudi Arabia.

Securities and Capital Markets Regulations

The CMA governs fintech activities in securities markets, including equity crowdfunding platforms, robo-advisory services, debt instrument trading platforms, and fund distribution platforms. These activities require fintech licensing in Saudi Arabia through the CMA’s experimental permit framework.

The Role of Fintech Certification and Standards

While fintech licensing in Saudi Arabia focuses on regulatory permissions, additional certifications and standards enhance credibility and demonstrate commitment to best practices.

ISO Standards for Fintech

International Organization for Standardization (ISO) certifications relevant to fintech include ISO 27001 for information security management, ISO 27701 for privacy information management, ISO 9001 for quality management systems, and ISO 22301 for business continuity management.

These certifications complement fintech licensing in Saudi Arabia by demonstrating adherence to internationally recognized standards. Alnafitha’s consulting services can guide companies through ISO certification processes aligned with licensing requirements.

Professional Fintech Certifications

Individual professionals supporting fintech operations benefit from certifications in financial technology, cybersecurity, compliance management, and risk assessment. Building a team with recognized credentials strengthens fintech licensing in Saudi Arabia applications.

Vision 2030 and the Future of Fintech Licensing in Saudi Arabia

Saudi Arabia’s Vision 2030 initiative drives ambitious goals for the financial sector, directly impacting fintech licensing in Saudi Arabia policies and opportunities.

The Financial Sector Development Program aims to have 525 active fintech companies operating in the Kingdom by 2030, increase cashless transactions to 70% by 2025, and position Saudi Arabia as a regional fintech hub. These objectives create favorable conditions for companies pursuing fintech licensing in Saudi Arabia.

Recent developments demonstrate the Kingdom’s commitment to fintech growth. In 2025, SAMA granted licenses to multiple new fintech companies, including debt-based crowdfunding platforms and finance aggregation services. The total number of SAMA-licensed finance companies reached 62, reflecting the expanding ecosystem.

The government’s supportive stance, combined with tech-savvy population and growing digital adoption, creates an environment where fintech licensing in Saudi Arabia opens doors to significant market opportunities.

Common Challenges in Fintech Licensing and How to Overcome Them

Companies pursuing fintech licensing in Saudi Arabia often encounter similar challenges. Understanding these obstacles and strategies to address them improves success rates.

Challenge: Complex Regulatory Navigation

The involvement of multiple regulatory bodies can create confusion about requirements and processes. Solution: Engage specialized consultants like Alnafitha IT who understand the regulatory landscape and can guide you through each step of fintech licensing in Saudi Arabia.

Challenge: Cybersecurity Compliance

SAMA’s stringent cybersecurity requirements demand sophisticated security infrastructure. Solution: Invest in comprehensive cybersecurity frameworks from the outset, including penetration testing, vulnerability assessments, and continuous monitoring systems. Alnafitha’s cybersecurity services provide the expertise needed to meet SAMA’s standards.

Challenge: AML and KYC Implementation

Automated systems for monitoring suspicious transactions and verifying customer identities are mandatory but complex to implement. Solution: Deploy proven AML and KYC platforms with strong track records in regulated markets, ensuring integration with local data sources and regulatory reporting systems.

Challenge: Documentation Requirements

The extensive documentation required for fintech licensing in Saudi Arabia can overwhelm applicants. Solution: Start documentation early, maintain organized records throughout business development, and work with consultants experienced in preparing successful applications.

Challenge: Technology Integration

Connecting with existing Saudi banking infrastructure and payment networks presents technical challenges. Solution: Build robust API layers and middleware capable of bridging modern fintech platforms with legacy systems, conducting technical audits with potential partners early in the process.

International Fintech Companies: Entry Strategies for the Saudi Market

International companies seeking fintech licensing in Saudi Arabia should carefully consider their market entry strategy based on their resources, risk tolerance, and long-term objectives.

Strategy 1: Establishing a Saudi Subsidiary

Creating a local subsidiary provides maximum control but requires significant investment in local presence, compliance infrastructure, and operational capabilities. This approach suits established fintech companies with resources to build substantial operations.

Strategy 2: Technology Licensing to Local Partners

Licensing fintech solutions to Saudi companies leverages local partners’ market knowledge and existing licenses while generating revenue without heavy capital investment. This strategy accelerates market entry but provides less control over implementation and customer relationships.

Strategy 3: Strategic Partnerships

Partnering with established Saudi financial institutions combines international technology innovation with local regulatory compliance and market access. Joint ventures can shorten go-to-market timelines while sharing compliance burdens.

Strategy 4: Sales Agent Appointments

Appointing local sales agents to distribute fintech products minimizes regulatory complexity while testing market demand. This lower-risk approach suits companies exploring market potential before committing to full fintech licensing in Saudi Arabia.

Each strategy requires careful consideration of regulatory implications, resource requirements, timeline expectations, and long-term business objectives. Alnafitha IT’s consulting services help international companies evaluate options and develop entry strategies aligned with their goals.

Conclusion: Your Partner in Fintech Licensing Success

Navigating fintech licensing in Saudi Arabia demands expertise in regulatory compliance, technology implementation, and market dynamics. The Kingdom’s ambitious Vision 2030 goals create unprecedented opportunities for fintech companies, but success requires thorough preparation and strategic execution.

Whether you’re a startup exploring the SAMA Regulatory Sandbox, an established financial institution expanding into fintech services, or an international company entering the Saudi market, partnering with experienced consultants significantly improves your chances of success.

Alnafitha IT brings over three decades of experience supporting businesses in Saudi Arabia’s technology sector. Their comprehensive services encompass regulatory consulting for fintech licensing in Saudi Arabia, cybersecurity implementation meeting SAMA requirements, technology infrastructure development and integration, ongoing compliance management and monitoring, and digital transformation strategies aligned with Vision 2030.

The Saudi fintech landscape is evolving rapidly, with new regulations, technologies, and opportunities emerging continuously. By understanding the fintech licensing in Saudi Arabia process, leveraging specialized expertise, and building robust compliance frameworks, your company can successfully navigate this dynamic market and capitalize on the Kingdom’s financial technology revolution.

Ready to begin your fintech licensing in Saudi Arabia journey? Connect with Alnafitha IT’s expert consultants to develop your customized strategy for regulatory success and market entry.