Payroll software has become essential for businesses operating in Saudi Arabia. Between GOSI contributions, end-of-service benefit calculations, Wage Protection System requirements, and evolving labor regulations, HR teams face a compliance landscape that demands precision and constant vigilance.

For growing businesses across the Kingdom, the question isn’t whether to automate payroll it’s finding the right payroll software for Saudi Arabia that truly understands local requirements. This guide examines what makes HR software effective in the Saudi context and how the right technology transforms workforce management from a compliance burden into a strategic advantage.

Understanding Payroll Software Requirements in Saudi Arabia

Saudi Arabia’s payroll software landscape involves multiple regulatory frameworks that interact in complex ways. HR professionals must navigate these requirements while maintaining accuracy and meeting tight deadlines.

How Payroll Software Handles GOSI Contributions

The General Organization for Social Insurance (GOSI) requires employers to calculate and remit contributions based on employee nationality, salary components, and current contribution rates. Saudi employees have different contribution structures than expatriate workers, and the calculations must account for various allowances and benefits. Manual processing creates significant error risk, especially when rates change or employee circumstances shift mid-cycle.

Payroll Software and WPS Compliance

The Ministry of Human Resources and Social Development monitors salary payments through the Wage Protection System. Every payment must be recorded accurately, with timing and amounts matching registered employment contracts. Discrepancies trigger investigations and can affect a company’s standing under Nitaqat, the Saudization program that governs workforce composition requirements.

Payroll Software for Saudi Labor Law Calculations

End-of-service benefits represent one of the most complex calculations in Saudi payroll. The computation depends on tenure length, reason for separation, and salary components—with different formulas applying to different scenarios. Overtime calculations, annual leave accruals, and termination settlements all follow specific legal frameworks that payroll software Saudi Arabia must handle correctly.

Why Generic Payroll Software Falls Short in Saudi Arabia

Many organizations discover too late that their HR software wasn’t built for Saudi requirements. International platforms often treat Saudi compliance as an add-on rather than a core function, creating gaps that HR teams must fill manually.

Missing Local Calculation Logic

Standard payroll systems typically lack native GOSI calculation engines. They may not distinguish between Saudi and non-Saudi employee contribution requirements. End-of-service calculations often require manual override or external spreadsheets. Each workaround introduces error risk and audit exposure.

Integration Challenges with Government Systems

Saudi government platforms have specific data format requirements and submission protocols. Payroll software that can’t generate WPS-compliant files forces finance teams into manual data transformation—a time-consuming process prone to formatting errors that cause rejection and resubmission cycles.

Arabic Language and Local Practices

Employee self-service portals need Arabic interfaces to serve the workforce effectively. Payslips, leave requests, and HR communications should support bilingual operations. Software designed primarily for other markets often treats Arabic as a translation layer rather than a native capability, resulting in clunky interfaces and incomplete localization.

Key Features of Effective Payroll Software for Saudi Businesses

When evaluating payroll software Saudi Arabia, prioritize solutions that address these essential capabilities:

Automated GOSI Calculations

Look for systems that calculate GOSI contributions automatically based on employee classification and current rates. The software should update when contribution rates change and handle mid-period adjustments without manual intervention. Native GOSI compliance software eliminates the spreadsheet gymnastics that create errors and audit findings.

End-of-Service Benefit Tracking

Effective automated payroll processing maintains running calculations of end-of-service liabilities for each employee. When separation occurs, the system should generate accurate final settlement figures based on tenure, salary history, and termination type. This capability proves essential for both day-to-day planning and accurate financial forecasting.

Attendance and Leave Integration

Payroll accuracy depends on reliable attendance data. Systems that integrate with biometric devices, mobile check-in, and leave management eliminate the manual data entry that causes payment errors. Employees should see their attendance records and leave balances in real time, reducing HR inquiries and disputes.

Employee Self-Service Portal

Modern HR operations empower employees to manage routine tasks independently. An employee self-service portal lets staff view payslips, submit leave requests, update personal information, and access tax documents without HR intervention. This automation frees HR teams for strategic work while improving employee satisfaction through immediate access to information.

Mobile Access for Distributed Workforces

Saudi businesses increasingly operate across multiple locations and time zones. Mobile-enabled HR software Saudi Arabia lets managers approve requests, HR teams process exceptions, and employees access information regardless of physical location. This flexibility proves essential for organizations with field staff, multiple branches, or remote work arrangements.

Zoho People & Payroll: Built for Saudi Business Requirements

Among available solutions, Zoho People has established itself as a full scale platform designed with Saudi business requirements at its core. The system delivers integrated HR and payroll capabilities that address the specific challenges organizations face in the Kingdom.

Native GOSI and Labor Law Compliance

Zoho People & Payroll includes built-in calculation engines for Saudi requirements. GOSI contributions process automatically based on employee nationality and current rates. End-of-service benefits calculate correctly whether an employee resigns, retires, or is terminated. The system stays current with regulatory changes, eliminating the lag that creates compliance exposure.

Complete HR Platform Integration

Unlike standalone payroll systems, Zoho People & Payroll connects HR functions throughout the employee lifecycle. Recruitment, onboarding, performance management, and offboarding all feed into payroll processing. This integration ensures consistency, reduces duplicate data entry, and provides comprehensive workforce analytics. Organizations using Zoho’s broader suite benefit from seamless data flow across all business functions.

Scalable for Growing Organizations

Startups and enterprises have different needs, but both require systems that grow with them. Zoho People & Payroll scales from small teams to large organizations without requiring platform changes. This scalability protects the investment in implementation and training as the business expands in alignment with Vision 2030 growth objectives.

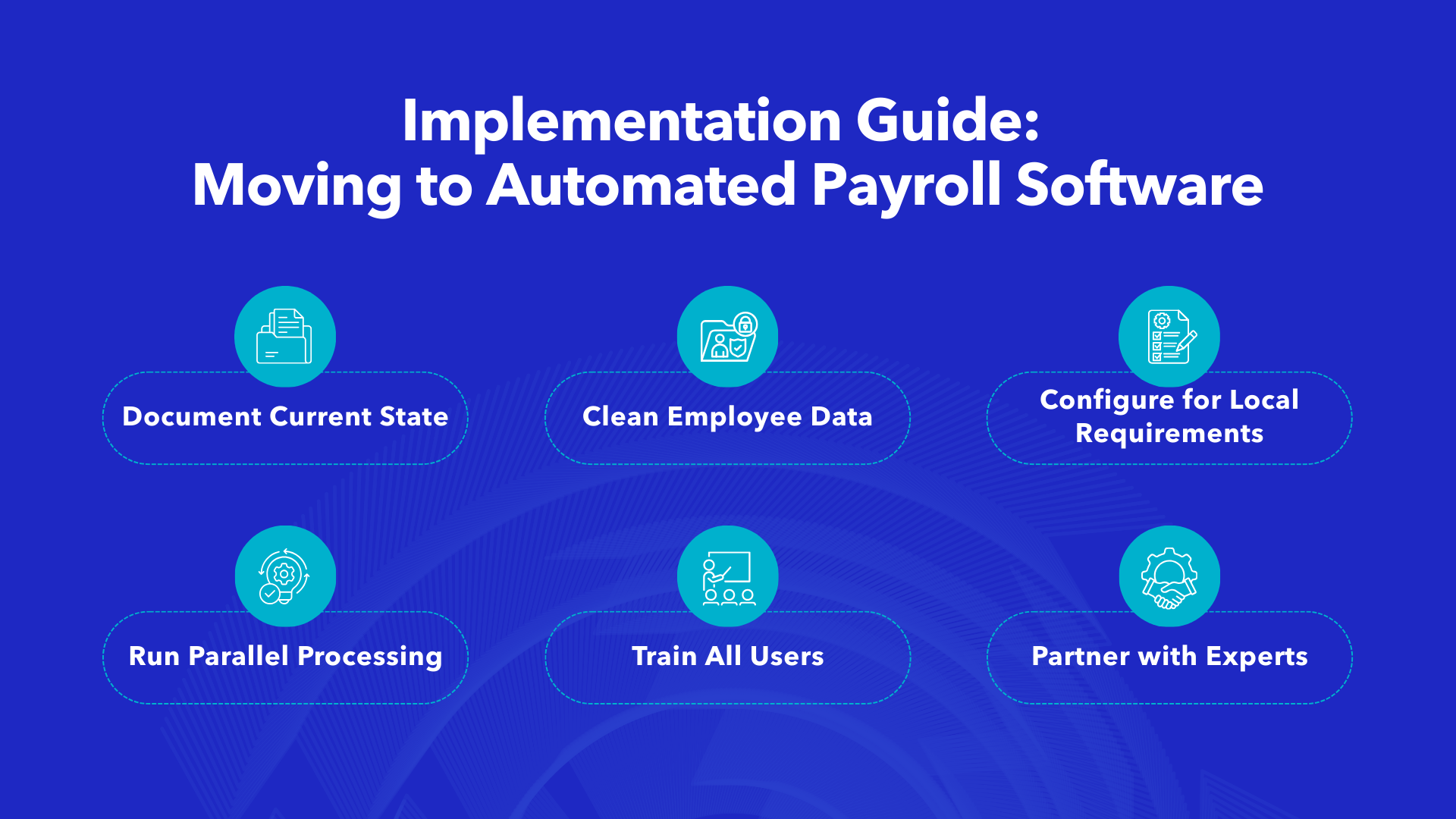

Implementation Guide: Moving to Automated Payroll Software

Successful payroll software implementation requires planning beyond software selection. Follow these steps to ensure a smooth transition:

- Document Current State: Map existing payroll processes, including all manual steps, spreadsheets, and workarounds. Identify pain points and compliance gaps that the new system must address.

- Clean Employee Data: Verify employee records before migration. Confirm GOSI registration numbers, salary components, and employment dates. Errors in source data transfer to the new system.

- Configure for Local Requirements: Work with your implementation partner to set up GOSI rates, salary structures, and calculation rules specific to your organization. Test calculations against known scenarios.

- Run Parallel Processing: Process payroll in both old and new systems for at least one cycle. Compare results to identify discrepancies before fully transitioning.

- Train All Users: Ensure HR staff understand system capabilities and processes. Train managers on approval workflows. Orient employees on self-service features.

- Partner with Experts: Work with a certified implementation partner like Alnafitha IT who understands both the software and Saudi regulatory requirements.

Transform Your HR Operations Today

Payroll compliance in Saudi Arabia will only grow more complex as regulations evolve and workforces become more distributed. Organizations that invest in purpose-built payroll software Saudi Arabia now position themselves to handle current requirements efficiently while adapting quickly to future changes.

The right system doesn’t just prevent compliance failures—it transforms HR from an administrative function into a strategic partner. When payroll runs automatically, when the employee self-service portal reduces routine inquiries, and when accurate data supports workforce decisions, HR teams can focus on the initiatives that drive business growth.

As an authorized Zoho partner, Alnafitha IT brings deep expertise in implementing Zoho People & Payroll for Saudi organizations. Our team understands local requirements and helps businesses configure systems that address their specific challenges from day one.

Eliminate payroll headaches Now

Contact our team for a demonstration of Zoho People & Payroll configured for Saudi labor law compliance. Book Your Free Demo