In an era where data breaches cost Middle Eastern organizations an average of $8.75 million per incident, Data Loss Prevention has evolved from a nice-to-have security feature to a business-critical necessity. For Saudi financial institutions, healthcare providers, and enterprises handling sensitive customer information, implementing robust Data Loss Prevention strategies isn’t just about security—it’s about survival in an increasingly regulated digital landscape.

What is Data Loss Prevention and Why Does It Matter?

Data Loss Prevention (DLP) refers to the strategies, tools, and processes organizations use to prevent sensitive information from being lost, misused, or accessed by unauthorized users. Unlike traditional security measures that focus on keeping threats out, Data Loss Prevention monitors data movement across your entire ecosystem—from endpoints and email to cloud applications and network traffic.

Modern Data Loss Prevention solutions work by identifying sensitive data (such as customer financial records, personal identification numbers, or intellectual property), monitoring how this data moves through your organization, and enforcing policies to prevent unauthorized sharing or exfiltration.

Data Loss Prevention and Saudi Regulatory Compliance

For organizations operating in Saudi Arabia, DLP is directly tied to regulatory compliance. The Saudi Arabian Monetary Authority (SAMA) Cybersecurity Framework explicitly requires financial institutions to implement controls that protect the confidentiality, integrity, and availability of information assets. This includes preventing unauthorized disclosure and unintended leakage of sensitive data, core capabilities of any enterprise-grade Data Loss Prevention solution.

Additionally, the National Cybersecurity Authority’s (NCA) Essential Cybersecurity Controls require organizations to classify data and implement appropriate protective measures. The Personal Data Protection Law (PDPL) further mandates strict controls over how personal data is collected, processed, and shared. A robust Data Loss Prevention strategy addresses all these requirements through unified policy enforcement and comprehensive monitoring.

Key Components of an Effective Data Loss Prevention Strategy

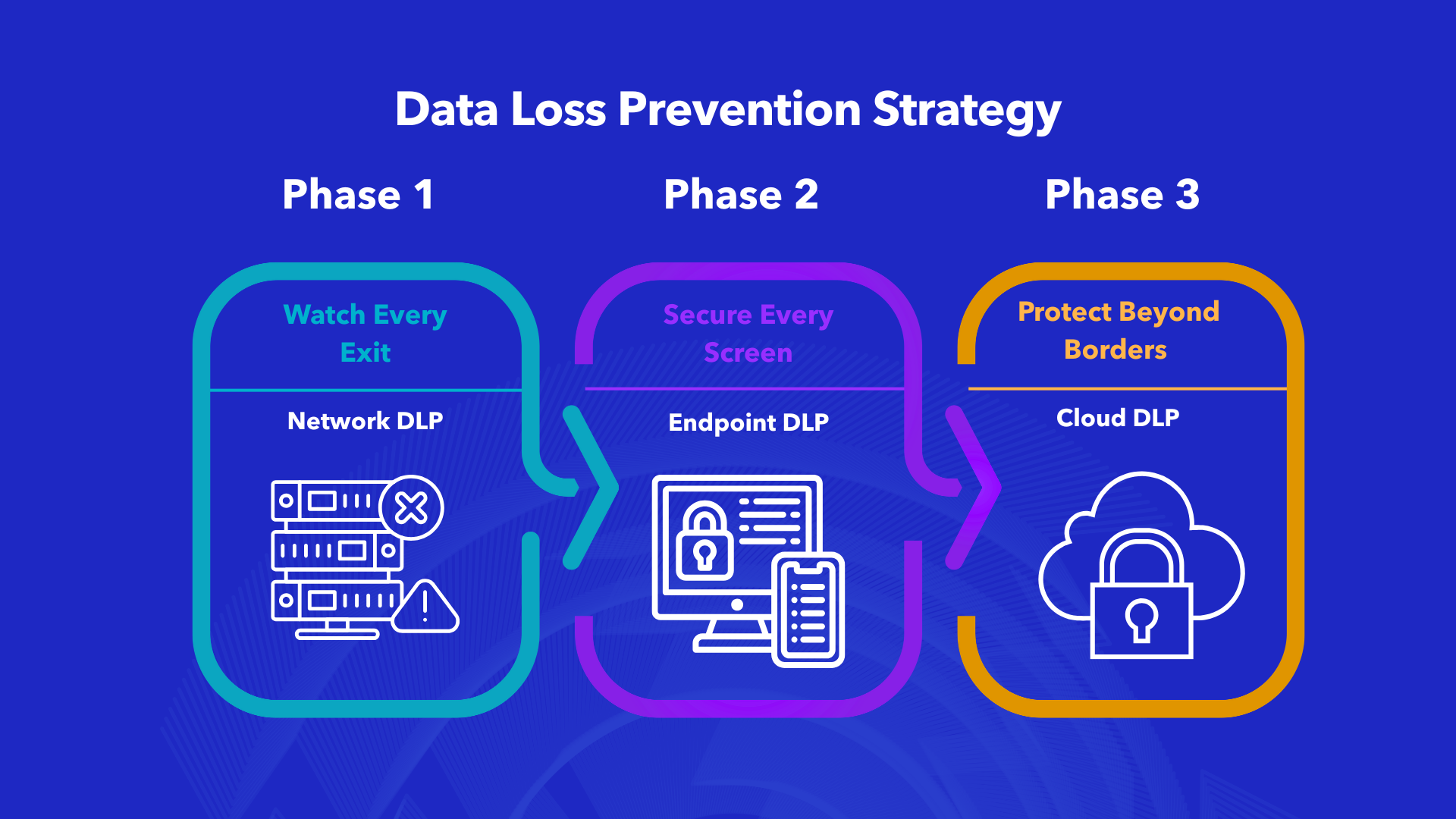

Successful Data Loss Prevention implementation requires a multi-layered approach that covers three critical areas:

1. Watch Every Exit (Network DLP)

Network DLP monitors data in motion as it travels across your network. This includes email communications, web uploads, file transfers, and any data leaving your network perimeter. For Saudi banks processing thousands of transactions daily, network Data Loss Prevention provides real-time visibility into potential data exfiltration attempts.

2. Secure Every Screen (Endpoint DLP)

Endpoint DLP protects data at rest and in use on employee devices—laptops, desktops, and mobile devices. With remote work becoming standard across Saudi enterprises, endpoint Data Loss Prevention ensures sensitive data remains protected regardless of where employees work. This includes controlling USB transfers, screenshot captures, and local file operations.

3. Protect Beyond Borders (Cloud DLP)

As Saudi organizations increasingly adopt cloud services like Microsoft 365 and AWS, cloud Data Loss Prevention becomes essential. Cloud DLP extends protection to cloud-hosted data, ensuring consistent policy enforcement across hybrid environments. This is particularly important for organizations leveraging multiple cloud platforms while maintaining data residency requirements within the Kingdom.

How Data Loss Prevention Addresses Common Security Challenges

Saudi organizations face unique challenges that make DLP particularly valuable:

Rising fraud losses: DLP helps detect anomalous data access patterns that often precede fraud, enabling security teams to intervene before financial damage occurs.

Increased SAMA expectations: With regulatory audits becoming more rigorous, Data Loss Prevention provides the documentation and reporting capabilities needed to demonstrate compliance.

Difficulty detecting real-time anomalies: Advanced Data Loss Prevention solutions use behavioral analytics to identify unusual data access patterns, even when the activity might appear legitimate at first glance.

High investigation workload: By reducing false positives and providing contextual alerts, DLP significantly cuts the time security teams spend investigating incidents—often from days to minutes.

Implementing Data Loss Prevention: Best Practices for Saudi Organizations

Successful Data Loss Prevention deployment follows a structured approach:

First, classify your data. Identify what sensitive data exists in your organization, where it resides, and how it flows. This foundational step ensures your DLP policies protect what matters most.

Second, define clear policies. Work with compliance, legal, and business stakeholders to establish DLP rules that balance security with operational efficiency. Overly restrictive policies lead to workarounds; too permissive policies leave gaps.

Third, deploy incrementally. Start your DLP implementation in monitor-only mode, analyze the results, refine your policies, then gradually enable enforcement. This approach minimizes business disruption while maximizing protection.

Finally, continuously optimize. DLP isn’t a set-and-forget solution. Regular policy reviews, incident analysis, and system updates ensure your Data Loss Prevention investment continues delivering value as threats and business requirements evolve.

Partner with Experts for Data Loss Prevention Success

Implementing enterprise-grade DLP requires more than technology, it demands expertise in Saudi regulatory requirements, deep understanding of regional threat landscapes, and proven implementation methodologies. As a 100% Saudi company with over 30 years of experience serving the Kingdom’s leading financial institutions and enterprises, Alnafitha IT combines global Data Loss Prevention solutions with local expertise to deliver data protection strategies that work.

Our cybersecurity team helps organizations see what their backend can’t, transforming hidden security signals into actionable intelligence that protects your business, ensures compliance, and builds customer trust.

Curious how DLP can secure your organization? Book your demo today and see how our solutions protect your critical data.