Saudi Arabia’s business landscape is undergoing a significant transformation. With ZATCA Phase 2 requirements now in effect, companies across the Kingdom face mounting pressure to digitize their financial operations. The question isn’t whether to adopt ZATCA-compliant accounting software, it’s how quickly you can implement a solution that keeps your business ahead of regulatory requirements while supporting your growth objectives.

For finance managers and business owners navigating this transition, understanding what makes cloud-based accounting software truly compliant—and how it can transform daily operations—has never been more critical. This guide explores everything you need to know about selecting and implementing the right ZATCA-compliant accounting solution for your Saudi business.

Understanding ZATCA E-Invoicing Requirements in Saudi Arabia

The Zakat, Tax and Customs Authority (ZATCA) introduced electronic invoicing requirements as part of the Kingdom’s broader digital transformation agenda aligned with Vision 2030. Phase 1, launched in December 2021, required businesses to generate and store invoices electronically. Phase 2 raised the bar significantly, mandating integration with ZATCA’s Fatoorah platform for real-time invoice validation and reporting.

Businesses operating in Saudi Arabia must now ensure their online accounting software can:

- Generate XML-formatted invoices meeting ZATCA technical specifications

- Apply cryptographic stamps and QR codes to all invoices

- Submit invoices to ZATCA’s platform within 24 hours of generation

- Maintain complete audit trails for all financial transactions

- Calculate and report VAT accurately across all transaction types

Non-compliance carries serious consequences, including financial penalties and potential business disruptions. More importantly, manual compliance processes drain valuable resources that could be directed toward growing your business. For detailed technical specifications, refer to the official ZATCA e-invoicing guidelines.

Why ZATCA-Compliant Accounting Software Must Be Cloud-Based

Traditional desktop accounting systems struggle to meet ZATCA’s real-time reporting requirements. Cloud-based accounting software offers distinct advantages that make compliance not just achievable but sustainable over the long term.

Real-Time Integration with ZATCA Systems

Cloud platforms maintain constant connectivity with ZATCA’s Fatoorah portal, enabling automatic invoice submission and validation. This eliminates the manual export-upload process that creates compliance gaps and delays. When you create an invoice in Zoho Books, for example, the system automatically formats, stamps, and submits it to ZATCA—all within seconds.

Automatic Regulatory Updates

ZATCA continues refining its requirements as the e-invoicing program matures. Cloud-based accounting software providers push updates automatically, ensuring your system always meets current specifications. With traditional software, you’d need to wait for patches, schedule installations, and risk gaps in compliance during update cycles.

Bank Integration and Reconciliation

ZATCA-compliant accounting software with bank integration capabilities transforms reconciliation from a time-consuming chore into an automated process. Direct bank feeds pull transaction data automatically, matching payments to invoices and flagging discrepancies for review. This level of automation proves especially valuable for businesses managing multi-currency transactions across the Middle East region.

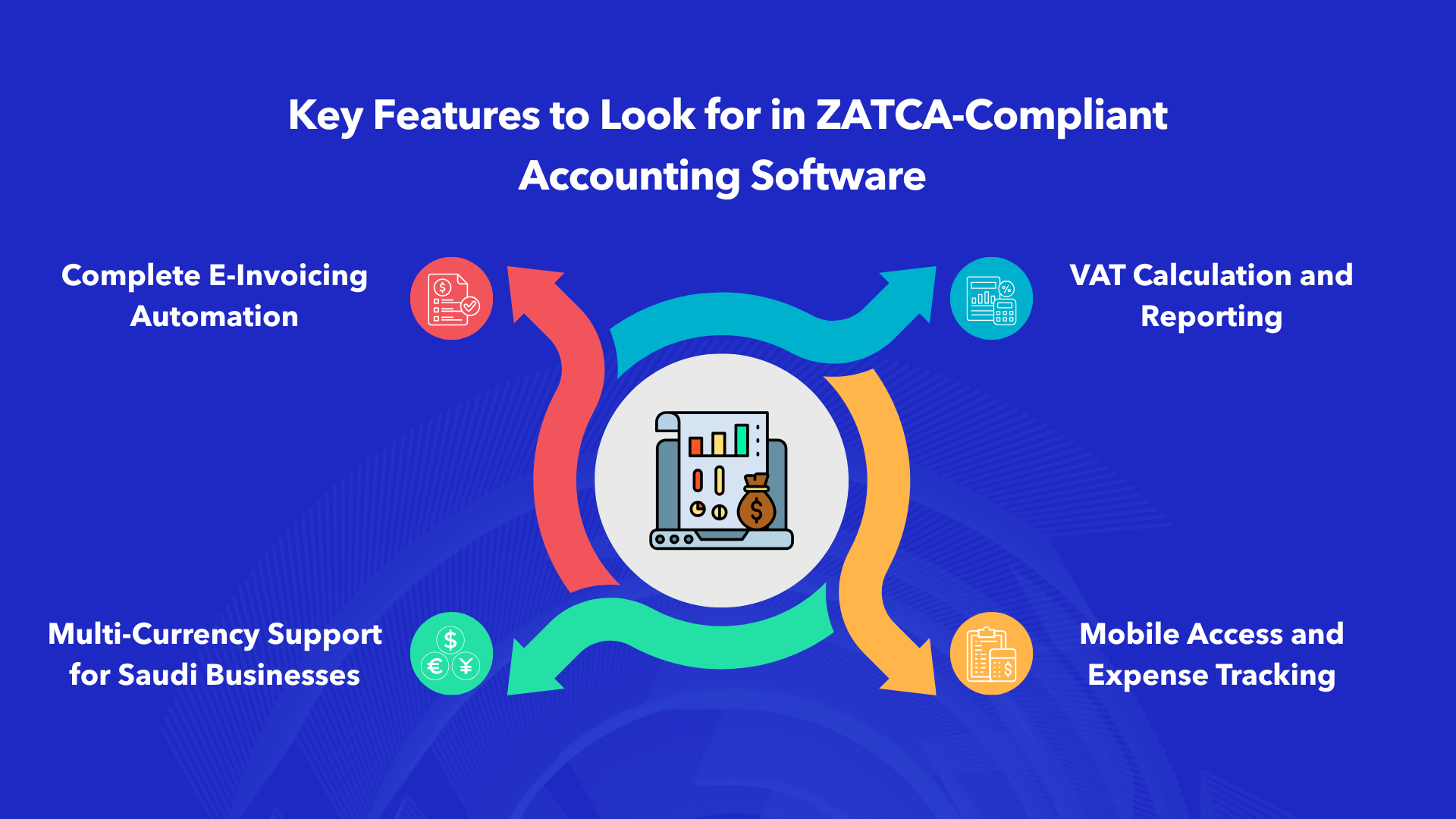

Key Features to Look for in ZATCA-Compliant Accounting Software

Not all accounting software claiming ZATCA compliance delivers equal value. When evaluating solutions for your Saudi business, prioritize these essential features:

Complete E-Invoicing Automation

Your online accounting software should handle the entire e-invoicing workflow automatically. This includes generating invoices in the required XML format, applying cryptographic stamps, generating compliant QR codes, submitting to ZATCA, and storing validation responses. Manual intervention should only be necessary for exceptions—not routine operations.

VAT Calculation and Reporting

VAT compliance extends beyond invoice generation. Look for software that automatically calculates VAT based on transaction type and customer location, generates VAT returns ready for submission, maintains detailed audit trails, and supports multiple tax rates for complex business structures. The best solutions also provide dashboards showing your VAT position in real time, enabling proactive cash flow management.

Multi-Currency Support for Saudi Businesses

Saudi businesses increasingly operate across borders, dealing with suppliers and customers in multiple currencies. Your ZATCA-compliant accounting software should handle currency conversions automatically, maintain accurate exchange rate records, and generate reports in SAR regardless of transaction currency. This capability proves essential for businesses supporting Vision 2030’s economic diversification goals.

Mobile Access and Expense Tracking

Finance teams can’t always be at their desks. Mobile-enabled accounting software lets you approve invoices, check financial status, and capture expenses from anywhere. For field-based businesses or executives who travel frequently, mobile access ensures financial operations continue smoothly regardless of location.

Zoho Books: ZATCA-Compliant Accounting Software Built for Saudi Businesses

Among the available options, Zoho Books has emerged as a preferred choice for Saudi businesses seeking comprehensive ZATCA compliance combined with powerful accounting capabilities. The platform delivers several distinct advantages that address the specific needs of organizations operating in the Kingdom.

Native ZATCA Phase 2 Integration in ZATCA-Compliant Accounting Software

Zoho Books offers direct integration with ZATCA’s Fatoorah platform, eliminating the need for third-party connectors or middleware. The system generates compliant invoices automatically, applies required security features, and submits them in real time. Finance teams receive immediate confirmation of acceptance or clear guidance on any issues requiring attention.

Localized for Saudi Financial Practices

Beyond technical compliance, Zoho Books understands Saudi business practices. The platform supports Arabic invoicing, accommodates local banking requirements, and generates reports formatted for Saudi regulatory bodies. This localization extends to customer support, with Arabic-speaking specialists available to assist with implementation and ongoing operations.

Integration with Business Ecosystem

Accounting doesn’t operate in isolation. Zoho Books connects seamlessly with e-commerce platforms, payment gateways, and other business applications. For organizations using Zoho’s broader suite—including Zoho CRM and HR tools—data flows automatically between systems, eliminating duplicate entry and ensuring consistency across all business functions.

Implementation Best Practices for ZATCA-Compliant Accounting Software

Successful implementation requires more than purchasing software. Follow these best practices to maximize your return on investment:

- Audit Current Processes: Document your existing invoicing and accounting workflows before implementation. Identify pain points and compliance gaps that your new software must address.

- Clean Historical Data: Migrating messy data creates problems in your new system. Take time to reconcile accounts, clear duplicate entries, and verify customer information accuracy before migration.

- Train Your Team: Even intuitive software requires training. Ensure finance staff understand both the technical operation and the compliance requirements your new system addresses.

- Test Before Going Live: Run parallel systems during transition. Verify that invoices generate correctly, VAT calculations match expectations, and ZATCA submissions succeed before decommissioning your old system.

- Partner with Experts: Consider working with a certified implementation partner who understands both the software and Saudi regulatory requirements. Alnafitha IT provides local expertise that accelerates deployment and reduces compliance risks.

Taking the Next Step Toward ZATCA Compliance

ZATCA compliance isn’t optional—but it doesn’t have to be painful. The right ZATCA-compliant accounting software transforms regulatory requirements from a burden into an opportunity for operational improvement. Automated e-invoicing reduces errors, real-time reporting improves cash flow visibility, and integrated systems eliminate the inefficiencies of manual processes.

For Saudi businesses ready to move beyond compliance checkboxes to genuine digital transformation aligned with Vision 2030, Zoho Books offers a proven path forward. As an authorized Zoho partner, Alnafitha IT provides the local expertise needed to implement these solutions effectively, ensuring your finance operations are prepared not just for today’s requirements but for whatever comes next.

Streamline your ZATCA compliance

Contact our team for a personalized demonstration of Zoho Books configured for Saudi business requirements. Book Your Free Demo